UK & Ireland Labour Market Analysis: A Mixed Picture for Winter 2023

Magnit January 23 2023

High inflation rates coupled with record low unemployment rates currently characterise a mixed picture for the UK and Irish labour markets at the start of the new year.

With global financial markets in turmoil over rising interest rates, an energy price crisis, global supply chain shortages, record inflationary pressure and the escalation of the war in Ukraine, the pressures on the market have been constant and diverse over the past year.

Let’s look deeper at the situation as it stands, in both the UK and Ireland.

UK Spotlight

Macro Environment in the UK

The UK employment market is starting to see the effects of the global economic downturn, particularly in terms of hiring opportunities, pay and benefits, and the cost of living. However, the market is coming down from what was a strong position, with record unemployment and a strong candidate-driven market.

The UK unemployment rate of 3.7% (OECD) as of October 2022 is lower than the average rate of the G7 at 4% and the EU average at 6%. However, with rising inflation at a 30-year high of around 10%, significant economic challenges are looming.

While the contingent labour market can potentially benefit from disruption due to a tendency to shift toward contingent models during a downturn, it may prove more difficult to convince candidates to move jobs. With the unemployment rate historically low, there is concern that the highly competitive candidate-driven market could become even tighter.

Skills in Demand in the UK

According to Magnit’s in-country experts, skills currently in high demand in the UK include:

- Data analysts with experience in financial services

- Cloud computing engineers

- AI solutions architects and candidates with VR, IOT and SQL skills and experience

- Global sales for managed services

Vacancy rates in the UK are plateauing and starting to drop after a very strong increase in 2021 and the first quarter of 2022. Local Magnit sources indicate this dip began in Q2 or Q3 of 2022.

Remuneration and Benefits in the UK

Pay rate and benefit changes have slowed in the wake of the economic turbulence of the last six months, but continue to evolve. Many workforce characteristics that emerged from of the pandemic continue, such as remote working, increased health and lifestyle benefits, and a focus on project work. According to Magnit’s experts, companies are increasingly emphasizing:

- Learning and development

- Diversity, equity & inclusion programming within organizations

- Opportunities for cash bonuses to account for the rise in living costs

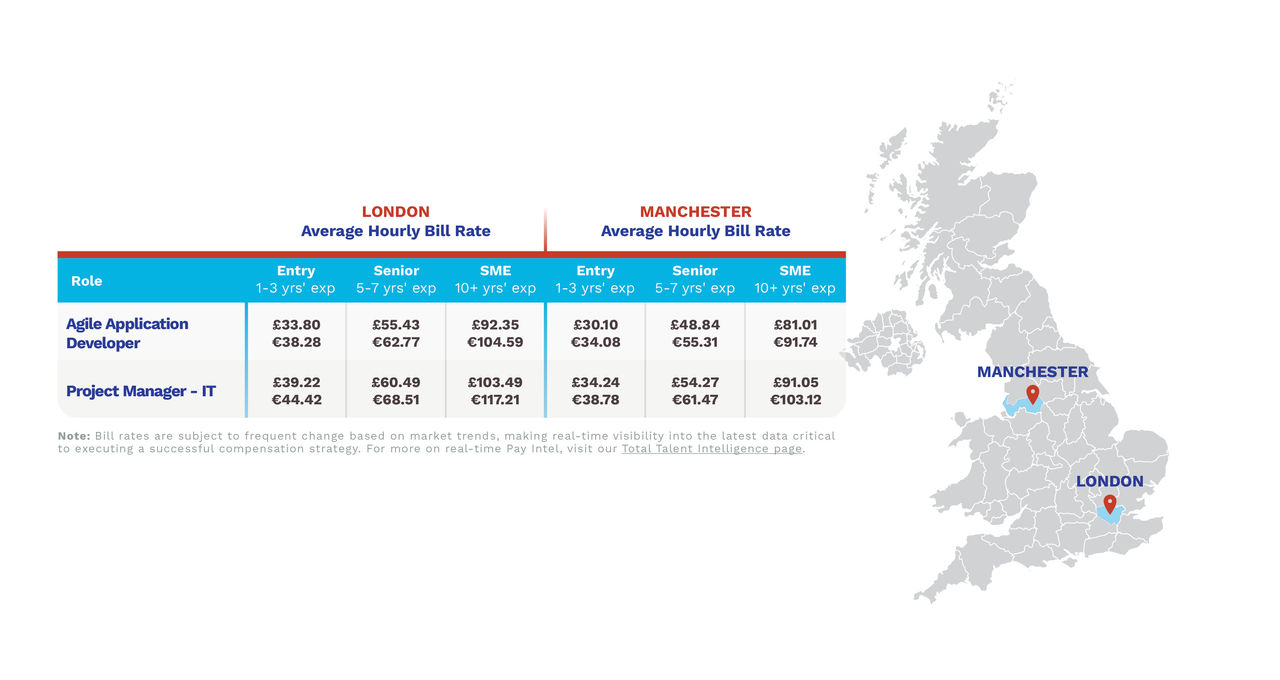

While hiring in the current economic landscape is proving challenging across Europe, Brexit has further exacerbated these difficulties and put UK companies at a recruitment disadvantage. This is reflected in our pay and bill rate data below.

But while workers see they could go elsewhere for higher pay, many hesitate to do so as they fear being “last in, first out” at their new employer should cuts need to be made. We expect this trend to continue with a possible worsening depending on the extent of the global recession. (Download the full Winter 2023 Labour Market Report for more insights on the UK and Europe.)

Ireland Spotlight

Macro Environment in Ireland

Ireland’s labour market is characterised by continuing high demand for talent, but there are signs wage inflation is slowing due to pressure from price inflation, interest rate spikes and the negative overall economic outlook of the Eurozone. Inflation has shot up by around 8% since November 2021, but the most recent data shows a trend toward inflation declining as evidenced by a quarter-to-quarter decrease of nearly 3% forecasted for Q1 and Q2 of 2023.

Magnit’s data on pay rate changes and time to fill indicates that both are continuing to rise as of Q3 2022 and are forecast to continue rising. This suggests there is still a tight labour market, with cost pressures on organizations looking to hire in Ireland being tempered by demand. Pay rates increased 4.4% between 2021 and Q3 2022, which is down from the near 8% growth the previous year. If the economy does degrade as many economists predict, we will likely see pay rates plateau or reduce.

Skills in Demand in Ireland

Key industries in the Irish labour market include pharmaceuticals and technology, with regional centers in Dublin for finance and technology, and Galway, the Midlands area and Limerick for pharmaceutical companies. Data analysts and data engineers, AI and Machine Learning (ML) candidates are in high demand and, in particular, software development and technology recruitment are major draws.

According to Magnit’s in-country experts, roles with higher levels of experience are the most difficult to source, with fewer available candidates due to the challenging market conditions.

Remuneration and Benefits in Ireland

The Irish labour market is still feeling the talent shortage, with time-to-fill at about two months. Key trends include:

- Roles in technology, data analytics and management are in the highest demand

- The skills shortage in the UK and Ireland is pushing salaries up across the board

- Employees are finding higher increases in new roles versus waiting on promotions in their current roles

In addition, remote work has become even more important than salary increases since the COVID pandemic, with workers in Ireland increasingly demanding it to foster a better work/life balance.

A Best-Practice for Sourcing Talent in the UK & Ireland Today

Extend Workers and Upskill Existing Populations

Extending active high-quality workers reduces the need for sourcing and helps keep rates locked in at the initial negotiation rather than sourcing at the current high rates driven by inflation.

To expand opportunities to retain and redeploy existing talent, offer upskilling opportunities and leverage data to match workers coming off assignment with current job openings. Increasing wages in conjunction with increased skills is also critical, especially with pay transparency being a hot topic across Europe and many leading organizations taking skills into account when recruiting top talent.

Download the Full Report for More

For more analysis of the European labour market, download our new report. The Winter 2023 Europe Labour Market Report features analysis on high-level trends across Europe, as well as a deep dive on the situation in some of Europe’s major markets. Discover the major impacts for the labour market in each geography, as well as best-practice tips for sourcing talent in Europe today.

If you’re interested in learning more about how Magnit is helping organizations implement winning contingent workforce programs globally, please contact a Magnit representative at info@magnitglobal.com.

Disclaimer: The content in this blog post is for informational purposes only and cannot be construed as specific legal advice or as a substitute for legal advice. The blog post reflects the opinion of Magnit and is not to be construed as legal solutions and positions. Contact an attorney for specific advice and guidance for specific issues or questions.