U.S. Labor Market Report Insights: “Blind” Sourcing Channels, In-Demand Skills, Offshoring and More

Dustin Burgess August 26 2024

Amidst rising unemployment rates but surprisingly steady job growth overall in 2024, organizations continue to take a cautious approach to labor in preparation for a potential “soft landing.” In this uncertain economic landscape, the U.S. labor market has been marked by strategic downsizing, a focus on revenue-generating roles, and a decrease in the temporary help sector, which declined to its lowest non-pandemic level since April 2014.

Despite the volatility, Magnit data suggests that contingent workers are becoming less risk averse. While voluntary terminations are still much lower than during the Great Resignation, the voluntary term rate has risen nearly 40% in 2024 from its low in early 2023. As the Federal Reserve monitors the macroeconomic environment with a possible rate cut later this year, the labor market is poised for more potential shifts.

Companies and workers will be adapting to this evolving landscape, focusing on technological advancements and education, flexible and targeted hiring, and optimizing sourcing strategies to attract top talent. To help organizations increase adaptability in today’s complex labor market, Magnit conducted a comprehensive analysis of extensive data sets for our “Summer/Fall 2024 U.S. Labor Market Report.”

Looking across key trends in sourcing, skills, offshoring, layoffs, overtime use and AI, we uncovered some fascinating data points and related actionable insights. Key takeaways from the report include:

1) “Blind” Sourcing Channels Are Driving Up Costs and Compounding Risk Exposure

Companies’ use of project work (independent contractors, SOW, etc.) increased 16.8% as a portion of total contingent workforce spend in Q2 2024 versus three years ago. A lack of visibility into these areas has increased rogue spend and misclassification risk for many organizations. To combat this, organizations must take steps to ensure they are able to track all staff augmentation, SOW workers and ICs they have access to, as well as related documentation.

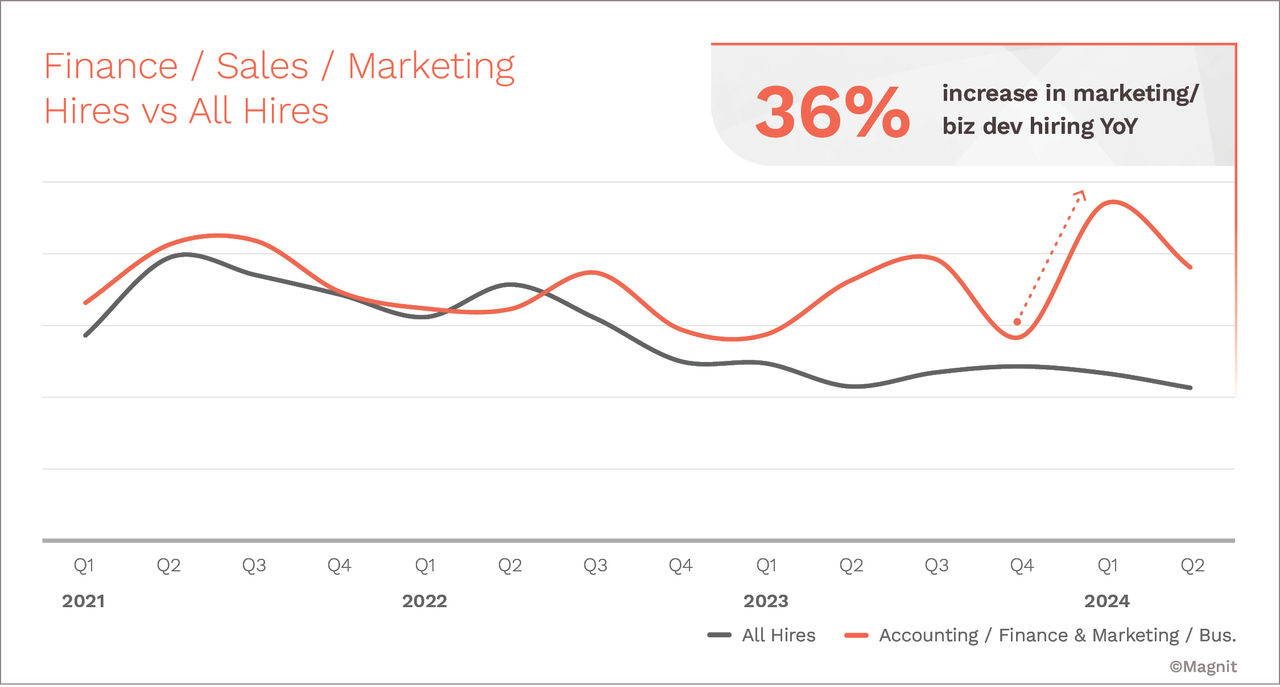

2) Amidst Strategic Downsizing, Sales/Biz Dev and Marketing Roles Are on the Rise

Organizations are exhibiting a renewed focus on seizing market opportunities, with hiring for marketing/business development roles up 36% YoY. In particular, hiring is up for roles that use data to make decisions, such as sales analysts (+25% YoY), marketing program managers and marketing analysts.

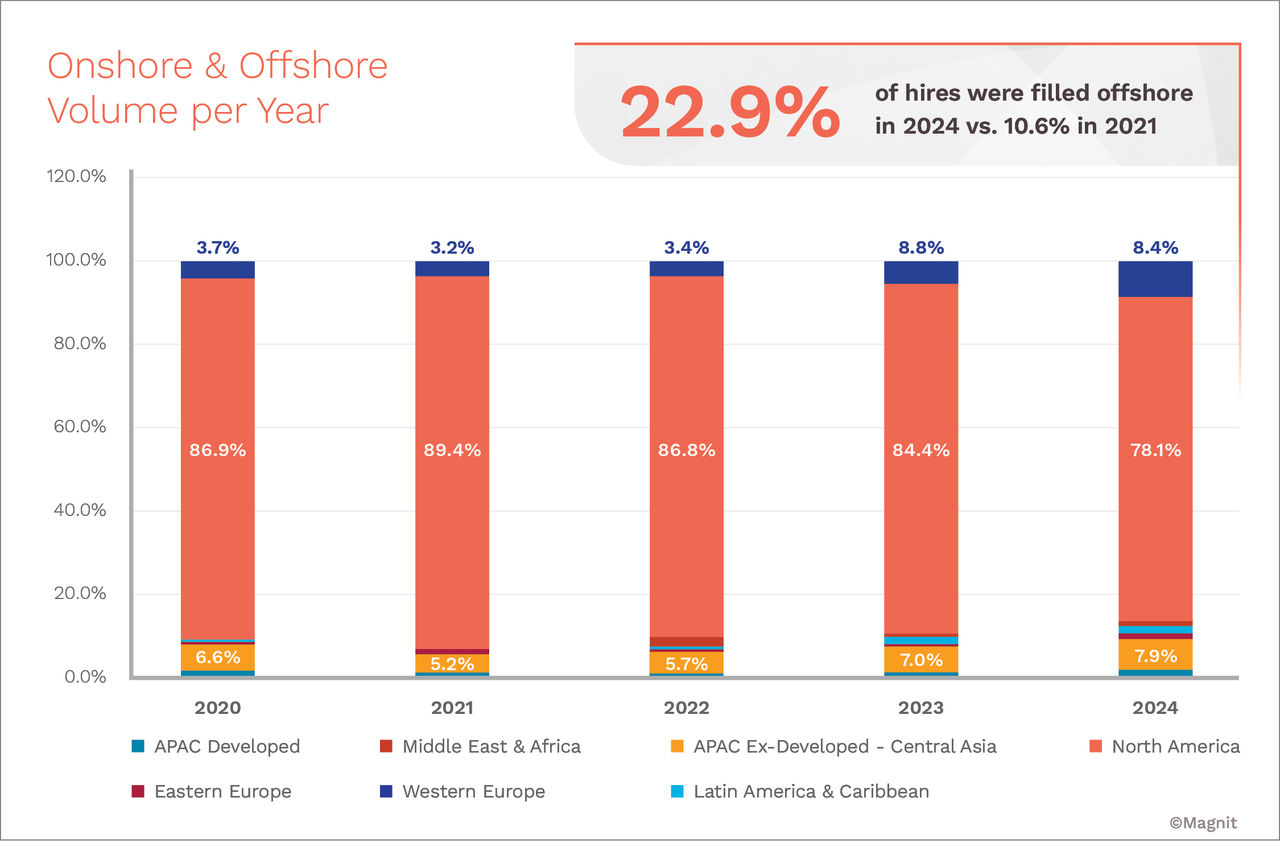

3) Offshoring Is Steadily Increasing

Organizations driven by cost management have steadily increased offshore hiring of contingent workers in recent years, with 2024 marking a five-year high for offshoring. Technology companies have been at the forefront of this trend, increasing their offshoring from 24% in 2020 to 31% in 2024. Given the current talent supply chain shortage, optimizing your sourcing strategy requires a careful balance of both onshoring and offshoring that demands current, reliable data and a significant amount of research and planning.

4) Enterprise Architecture and Compliance Skills Rank Hardest to Source

Amidst rapid digital transformation, a surge in demand for professionals skilled in enterprise architecture (+9% YoY) has outpaced supply nationwide. Furthermore, regulatory complexity and increased security threats have driven demand for compliance and controls framework skills (+11% YoY) across industries. Magnit data indicates that the demand for specific skills varies widely across different regions in the U.S., so making sure you’re factoring in this data as you’re building your talent strategy for roles that can be remote.

For much more on these areas, plus deeper dives into what companies need to know about the rise of AI, how they can approach layoffs more strategically, and tactics for optimizing overtime use, download the full report.

Disclaimer: The content in this blog post is for informational purposes only and cannot be construed as specific legal advice or as a substitute for legal advice. The blog post reflects the opinion of Magnit and is not to be construed as legal solutions and positions. Contact an attorney for specific advice and guidance for specific issues or questions.