Winter 2023-24 U.S. Labor Market Insights: Industry Spotlights

Dustin Burgess January 19 2024

The U.S. labor market saw numerous shifts in 2023, from labor shortages to the rise of Artificial Intelligence (AI) skills, which we covered in our previous Labor Market Report blog. As we enter 2024, we’re highlighting critical trends for organizations to keep an eye on as they revisit their talent strategies. In this blog post, we’re going to cover labor market trends pertaining to various industries, including financial and business services, IT and Technology, and Life Sciences.

Financial and Business Services Industry Sees Rise in Demand for Marketing Positions

The financial and business services industry saw significant contingent hiring at the end of 2023, with annual declines of only 0.12%, as opposed to a 23% decline in hiring for all sectors in the U.S. during the same time frame. Additionally, the average pay rates for 2023 in this sector came in at $60.77 an hour, which is the highest yearly rate average in the last 6 years (and a 7.9% increase from 2022). The disruption and digitization brought on by the COVID-19 epidemic also expedited a fundamental shift in this industry's focus toward the customer experience.

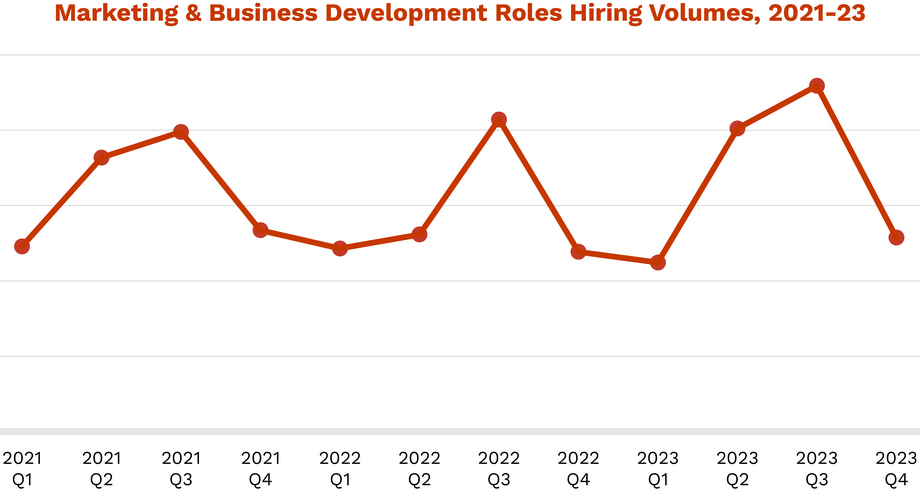

These developments resulted in a rise in demand for marketing positions that can inform the market about these new customer-focused offerings, in addition to sales roles that can turn that customer experience into revenue for organizations. Over the past two years, companies in this industry have steadily boosted recruiting for marketing and business development positions, whereas hiring in the IT/technology and life sciences, for instance, has fallen (see the chart below)

According to Magnit data, the top skillsets hired for the Financial and Business Services through the fourth quarter of 2023 are:

- UI/UX

- Content & Publications

- Analysis

IT and Technology Sees Hiring Competition for Creative Roles

Consumer goods and services companies have historically prioritized creative positions in the contingent talent market. Hiring for this type of role was dominated by the sector with 61% of all fills in 2019. To design and support the products they bring to market, businesses in this sector employ legions of graphic designers, content and creative writers, and product designers each year.

Although the consumer products and services industry is still hiring for these positions, competition has recently expanded to include the IT/technology industry, and to a lesser degree the financial and business service industry. With a combined share of 70% of fills YTD, they have surpassed the consumer products and services industry, which accounts for only 30%.

Other notable trends in the IT/technology industry according to Magnit data include:

- The average worker quality for the IT/technology industry is 4.3 out of 5 – higher than any other industry.

- The average pay rate for 2023 in this sector was $51.92, which is the fourth highest in the last six years (and an 8.6% decline from 2022).

- While Big Tech layoffs have grabbed headlines in early 2024, in 2023 the IT/technology industry had one of the lowest layoff rates at 3.2%, which is a record low in the last six years (and is much lower than the highs of 8.5% in 2021 and 4.7% in 2022.)

According to data derived from our labor market report, the top skillsets hired for IT/Technology through the fourth quarter of 2023 are:

- Digital Media

- Production

- Senior Leadership

Field Crop Farmworker Roles Lead Hiring in Life Sciences Sector

In 2023, field crop farmworkers dominated hiring for contingent roles in the life sciences industry, as they made up 12.7%% of all hires through the fourth quarter of 2023. In fact, field crop farmworkers accounted for 6.3% of all life sciences hiring in Q4 2023. Possible causes for this shift in demand could be:

- The adoption of AI in agriculture, creating new opportunities and requiring new skillsets

- Talent supply shortages due to aging and immigration policies

- The life sciences industry expanding research and development in agriculture

Field quality control specialists and greenhouse technicians are other noteworthy positions, both of which saw hiring increase about 3% in 2023. The average pay rates for 2023 in this sector was also $49.35 an hour, which is the highest yearly rate average in the last 6 years (and a 33% increase from 2022).

Overall, however, recruiting in the life sciences overall has dropped or remained unchanged for almost every job category, with the exception of the supply chain category, which has been expanding 34% every quarter in 2023. The layoff rate for the industry for the year was also 5.3%, which is just slightly higher than the six-year average of 4.8%.

Magnit data reveals that the top skillsets hired for Life Sciences and Chemicals through the fourth quarter of 2023 are:

- Quality Control

- Business Development

- Inventory Management

As we begin the new year, we will keep analyzing developments across industries, so organizations can utilize these insights to stay ahead in the war for talent and make better informed decisions about their talent strategy.

Gain more knowledge on the latest trends in the U.S. labor market when you download the full U.S. Labor Market Report.

Disclaimer: The content in this blog post is for informational purposes only and cannot be construed as specific legal advice or as a substitute for legal advice. The blog post reflects the opinion of Magnit and is not to be construed as legal solutions and positions. Contact an attorney for specific advice and guidance for specific issues or questions.