Life Sciences Industry Trends: Strategic Insights and Key Takeaways

Angela Arriaga October 31 2024

The life sciences industry has gone through significant shifts in the past year. The use of artificial intelligence (AI) is increasing to improve efficiency, reduce risks, and manage regulatory challenges, allowing companies to focus more on innovation. Outsourcing is also on the rise, with small and mid-sized companies partnering with CMOs and CROs to cut costs amid inflation, leading to fewer in-house jobs. Supply chain management is being streamlined, with a focus on vendor due diligence and stronger cybersecurity. Additionally, environmental sustainability is a growing priority, while the biotech sector is adopting leaner, more capital-efficient operations, often relying on outsourcing.

In this blog post, we are going to discuss the trends Magnit has seen in the life sciences sector from Q2 2022 to Q3 2024 in hires, layoffs, and voluntary terms, the top roles in the U.S., as well as effective strategies life sciences companies can implement to get highly sought after talent.

Hires, Layoffs & Voluntary Terms Trends and Key Takeaways

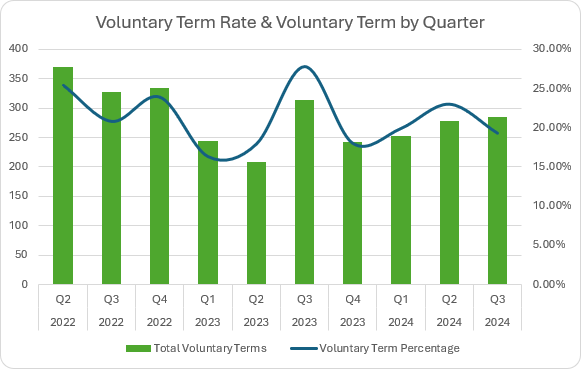

Voluntary terminations typically follow hiring trends because as more workers find new opportunities, companies need to hire more to backfill roles. According to Magnit data, voluntary terminations trended downward from a high in Q2 2022 through Q2 2023. Additionally, Q3 2023 saw a 50% increase in voluntary terminations quarter over quarter, which is the highest in the last eight quarters. The two quarters after that, voluntary terminations dropped and leveled off into Q1 2024. The Q2 2024 voluntary terms were also up 11% quarter over quarter, which suggests that workers were increasingly less risk-averse than the same time last year. In the third quarter of this year, voluntary term volume rose by 2%, but the voluntary term rate (voluntary terms divided by total terms) went down about 4 percentage points.

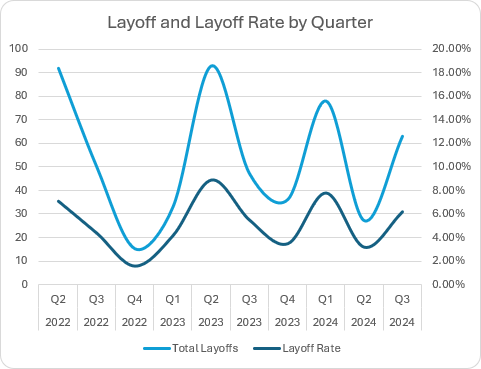

According to Magnit data, layoffs increased dramatically from the low in Q4 2022 and peaked in Q2 of 2023. From there, they dropped into the end of 2023 but started to pick back up in Q1 of 2024. In the last nine quarters the layoff rate was highest in the second quarter of 2023, hitting 8.9%. And although Q1 2024 hiring started off the year stronger than Q1 2023, the layoff rate was much higher (7.8% in Q1 2024 vs 4.20% in Q1 2023), and is trending to rise in Q3 2024 as well. This points to the sector restructuring their workforce as they increased both hires and the layoff rate.

While the life sciences industry increased hiring and layoffs at the same time, this is not an efficient approach. Instead, companies should use predictive analytics to accurately estimate demand and lower abrupt layoffs and hiring. They should also try to use AI tech in combination with workforce data identify opportunities to upskill, reskill- cross-train and redeploy current workers in the organization.

Top 8 Life Sciences Roles in U.S.

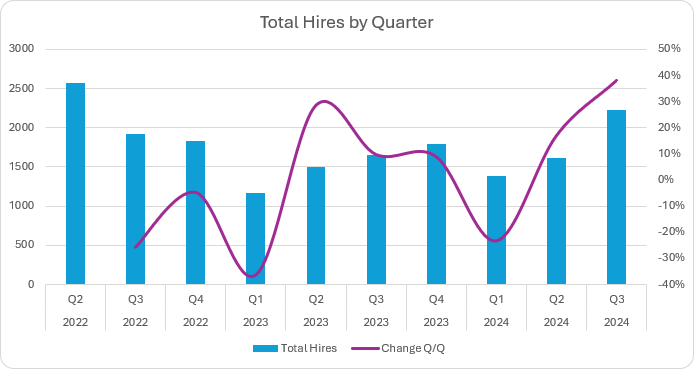

A difficult biotech financing climate, uncertainty around legislative and policy changes, and an uncertain economic outlook characterized 2023 for the life sciences sector. 71% of life sciences businesses intended to grow their personnel in 2024, with more than one-third hoping to boost headcount by more than 10%, according IQVIA study. According to Magnit data, hires increased significantly from Q2 to Q3, 38% quarter over quarter and 35% over the same quarter last year.

Data from Magnit also shows that hiring demand for positions including clinical research scientist, instrumentation technician, and quality control associate are very high. You can find the top eight life sciences role in the U.S. below.

- Chemist

- Clinical Research Scientist

- Instrumentation Technician

- Laboratory Assistant

- Laboratory Technician

- Medical Device Assembler

- Production Technician

- Quality Control Associate (Pharmaceutical)

To stay competitive in the war for talent, life sciences organizations will need to implement various strategies to improve their access to top workers.

Proven Strategies to Getting Ahead in Life Sciences Talent Acquisition

In order for life sciences organizations to attract highly sought-after talent, they can utilize several strategies. Investing in pay intelligence, for example, offers insights on real-time, location-based, bill rates. Organizations can then strengthen attrition efforts, save on costs for sourcing, enhance talent strategy, while maintaining a competitive advantage.

Life sciences organizations can also use curated talent communities, which are networks of pre-screened professionals with specialized expertise, to fill hiring positions. By providing access to a ready pool of qualified applicants, these communities assist companies in expediting the hiring process and cutting down on the amount of time needed for sourcing and screening. When combined with direct sourcing, businesses can hire more quickly and effectively by utilizing these talent pools. Curated communities also encourage ongoing engagement with prospective candidates, developing relationships that lower the cost and improve the effectiveness of future hiring.

Finally, life sciences organizations can invest in skills-based hiring, which focuses on specific skills instead of traditional qualifications like degrees. By taking this approach, they can find hard to find skills more affordably and optimize pay rates. In addition, they can expand talent pools, improve the worker experience, increase worker redeployment, and improve workforce planning overall. Learn more about the fundamentals to deploying a skills-based hiring approach in our blog.

For more insights on the latest developments in the life sciences sector, delve into our 2024 Life Sciences Talent Demand Report.

Disclaimer: The content in this blog post is for informational purposes only and cannot be construed as specific legal advice or as a substitute for legal advice. The blog post reflects the opinion of Magnit and is not to be construed as legal solutions and positions. Contact an attorney for specific advice and guidance for specific issues or questions.